How Mutual Fund ratings can be misleading

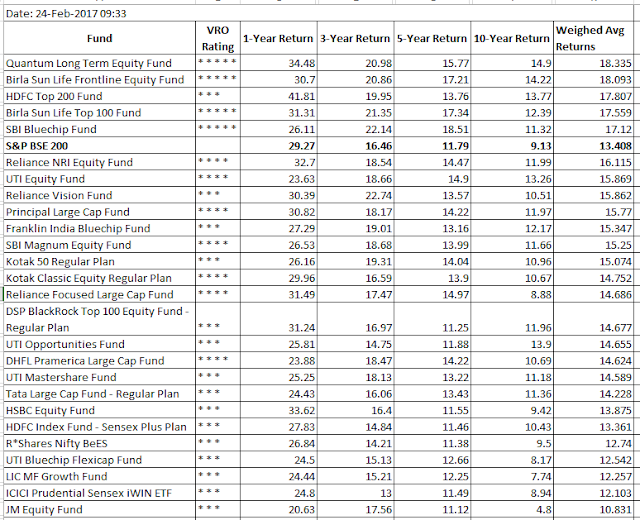

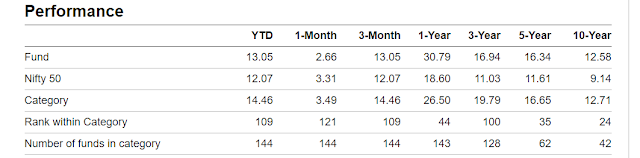

I hold ICICI Prudential Top 100 Fund in my portfolio and according to Valuersearch its a 3 star rated fund in muti-cap category. Also according to valueresearch, the fund is ranked low compared to other mutual funds in multi-cap category. The 3 year returns for the fund is 16.94% while average returns for the category is 19.79% Similarly the fund returns are below the category average for 5 year and 10 Year period. My first reaction was to sell it off and buy a good large cap fund instead. On doing some more analysis I found that ICICI Prudential Top 100 is in fact a large cap fund and valueresearch for some reason labels it as multi-cap. As a consequence the returns for this fund appear low compared to multi-cap funds and gets low rating which is not correct. The fund description in ICICI mutual fund website clearly mention that this a large cap fund. https://www.icicipruamc.com/icici-pruden...