What rolling returns tell us about a Mutual Fund performance

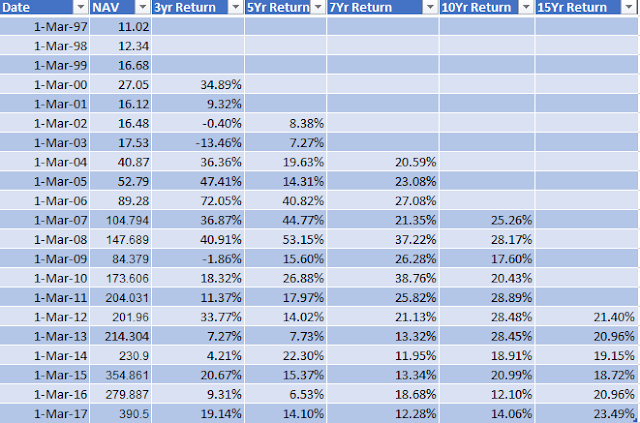

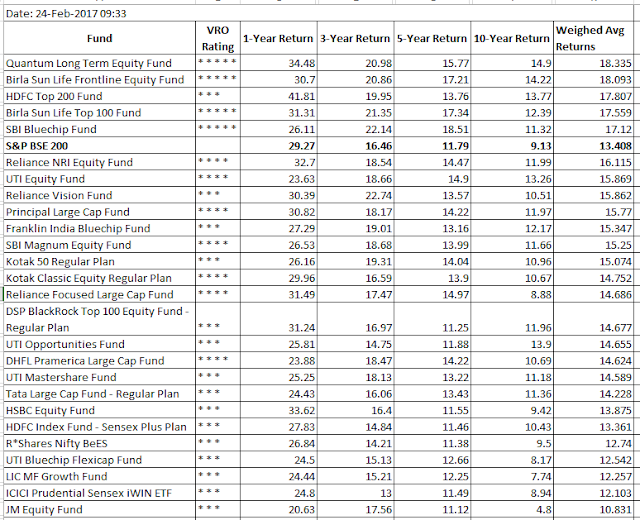

Most of the Mutual Fund rating websites list the past return as on today. It helps to gauge how fund have performed in past as of today, but doesn't tell how fund has performed if the returns were calculated in past date. For example 3-year return for a fund may be 20% today, but what about 3-year returns of the same fund in past years. This is where concept of rolling returns come into play and is more effective tool, to determine the consistency of a fund in delivering good returns year after year. I wish mutual fund website could incorporate this feature and also rate the funds accordingly. Lets try an example using HDFC TOP 200 fund which has history of more than 20 years and it would be interesting to know, how the fund has performed in past based on rolling returns. I have calculated rolling returns of the fund , for 3-year, 5-year, 7-year, 10-year and 15-year period based on NAV on 1st of march. Over a 3 year period returns are unpredictable and therefore its go...

Comments