Investing and Cricket

Investment is like cricket game and there are similarities which can be explained.

20–20 cricket is exciting and you see many six and fours every now and then. Many of us also wish to see our money grow like runs flow in a 20–20 game. An investor who wants double his money in one year is like a 20–20 batsman who wants to score runs at high strike rate. Batsman has to take risk on every ball to score quickly but more often than not they fail to score consistently in every game.

Similar thing happens to investors who risk their money to chase short term returns. Trying to hit six and four on every ball is like investing in risky assets hoping to get 50% returns every month.

Intraday trading, futures and options, flipping real estate are equivalent to 20–20 cricket game, exciting and full of action but difficult to perform consistently. New heroes emerge and fall and records get created and broken over a short period time.

Test match which is longer form of the game, appear dull and boring but it is where the maximum runs are scored. The probability of scoring consistent 100’s and double 100 is much more in a test match compared to a 20–20 game.

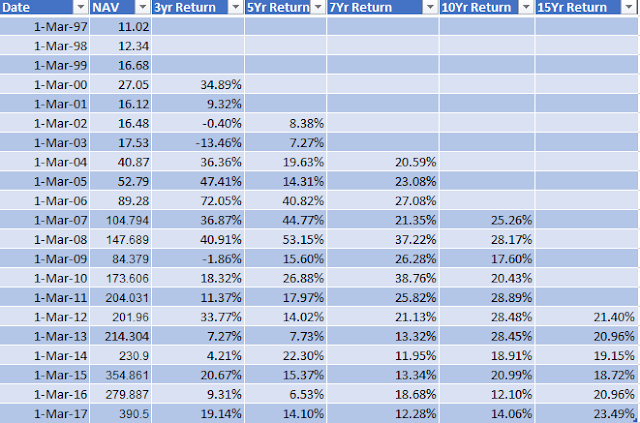

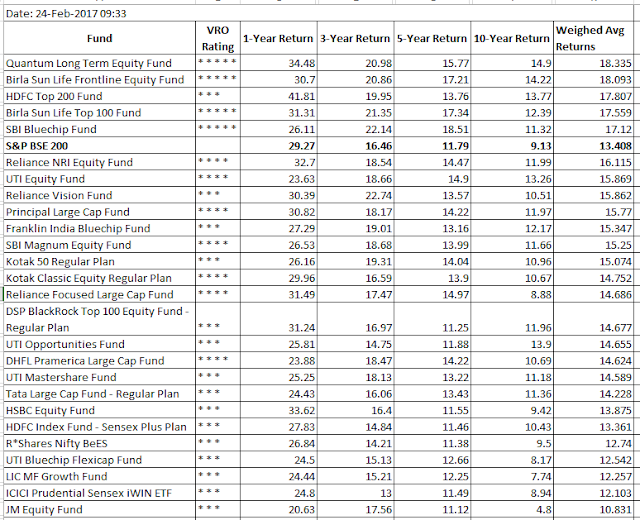

You wait for loose ball to hit a six or four, just like a long term investor waits for market correction to take big position. Similarly if you want to generate big returns, you need to play long version of investment game.The longer a team or batsman stays on pitch the higher the chances of winning the match, just like longer you stay invested, higher the returns. The number of overs are plenty in a test match and you are not in hurry, in real world if you start investing early time is in on your side.

Warren Buffet and Peter Lynch of investing world are comparable to Sunil Gavaskar and Sachin Tendulkar. They have accumulated massive returns or runs by being patient and disciplined.

Comments