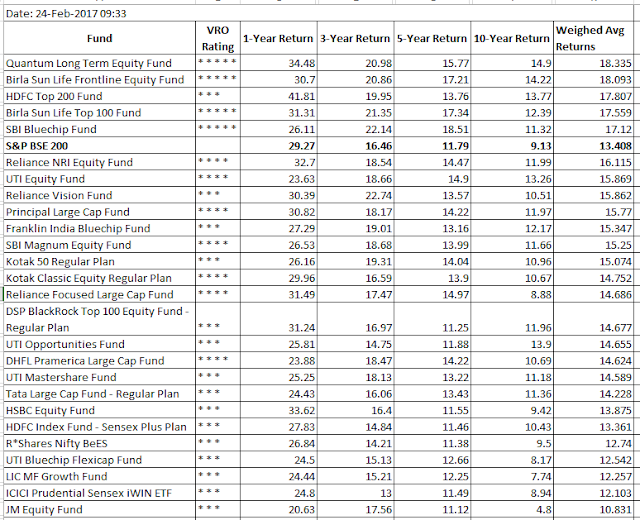

Top 5 equity mutual funds in each category with consistent returns

In my earlier post I laid down some rules to evaluate Large Cap funds http://moneybhasa.blogspot.in/2017/02/top-5-large-cap-mutual-funds-with.html In this post I will evaluate all equity mutual funds in different categories in a single post Large cap Muti cap Mid/small cap Tax planning ELSS funds The criteria remains same and reproducing it below. The fund should have at least 10 years of history. The data from value research is used which lists returns over 1-year, 3-year, 5-year and 10-year periods. The returns are as on date 24-Feb-2017. The weighed average return is calculated by assigning following weights based on duration of returns. Annual compounded returns are taken into consideration. For 10 year returns weight is 40 out of 100 For 5 year returns weight is 30 out of 100 For 3 year returns weight is 20 out of 100 For 1 year returns weight is 10 out of 100 Hence ...