Why only a small percentage of Indians Invest in Mutual Funds?

I answered the question on Quora .

There are many factors, some of them I can list down based on personal experience.

- Indians invest majority of income on house and gold and that leaves them little to invest in other avenues.

- Financial education has not yet caught up to educated people of our country. There are many among us who are unaware of the fact that Long Term Capital Gains from equity mutual funds are tax free.

- There are many misconceptions regarding equity investments, for example trading in shares and investing in shares is considered as same thing .

- I would also partly blame the Investment agents (Banks, LIC, Insurance), often giving wrong advice to customers. Insurance is mixed with investments which are separate things.

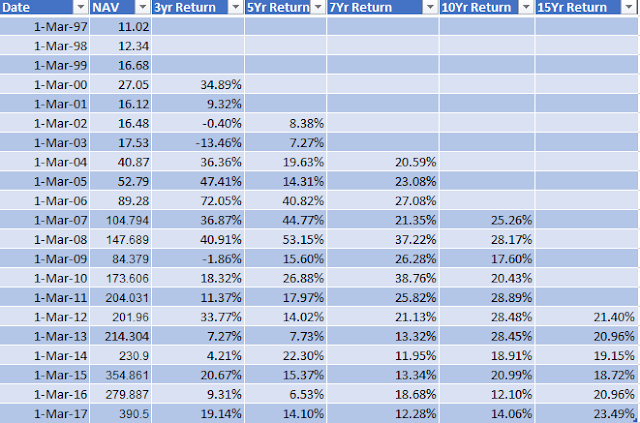

- Everyone wants to get rich quickly so the time horizon for investment is very less. Over a short period of time Mutual Funds or Equities deliver unpredictable returns, but people often overlook the power of compounding over large period of time.

- There is big entry barrier for investing in Mutual Funds, KYC norms are strict compared to banks which have wider reach compared to Mutual Fund Houses, so people are more comfortable with FD.

Comments