Best advise ever received for mutual fund

I answered this question on Quora

I have received many great advises thanks to one of blogs Subramoney and have benefited immensely from same. Some of them which I can remember are as follows.

I have received many great advises thanks to one of blogs Subramoney and have benefited immensely from same. Some of them which I can remember are as follows.

- You only need 2–3 funds from good fund houses without need to constantly check their performance.

- Fund manager is more important than the Mutual Fund itself for delivering consistent returns.

- Fund Management cost has big impact on your overall returns, even a difference of 0.5 percent of FMC charges can shave off lakhs of rupees from your final returns due to inherent nature of compounding.

- Starting early is key to financial freedom.

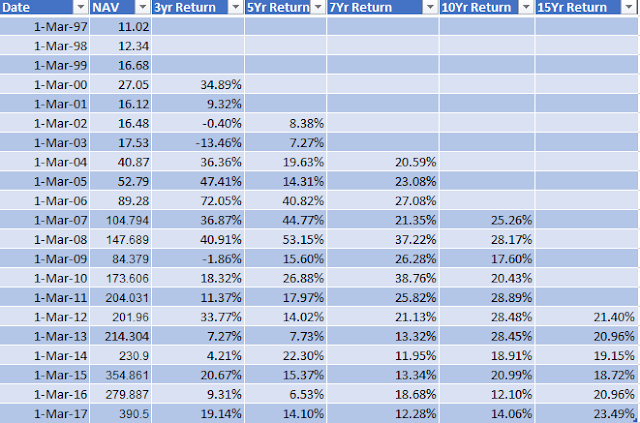

- Don’t sell your fund just because it has few bad years, the fund manager might be having a contrarian view and he may be doing something different. For example HDFC Top 200 had some bad years, but it has now become one of the best funds again.

- Investing very less amount in Mutual Funds SIP compared to your income, is not going to make you wealthy. Many people invest just 2000 on SIP even if they could have easily done SIP of say rs 15,000.

- When you invest in equities, you invest in underlying business, and the business borrows at market rate of say 8–10% and in order to make profit, it has to generate much higher returns of 15–20% and this is the return you can expect from a good business.

Comments