Can Sensex returns be predicted based on PE ratio

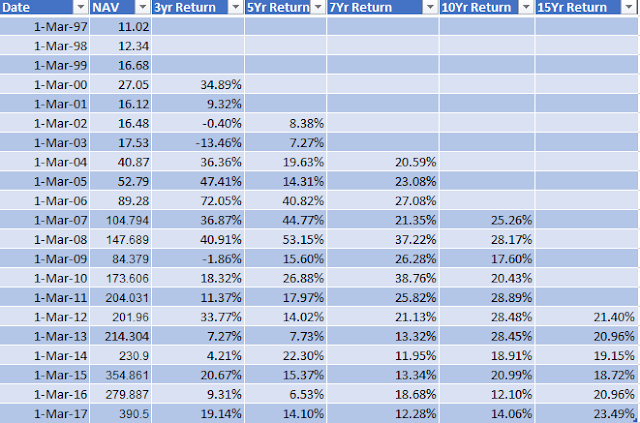

Morningstar had published statistical analysis to predict the sensex returns for 2 years based on overall sensex PE (Price to Earning) ratio.

http://www.morningstar.in/posts/36274/how-investors-can-use-the-pe-ratio.aspx

The results are interesting and give us fair idea where sensex might be headed in coming 2 years.

For example if Sensex PE is in range 16-17 the model predicts 26% return over two years and actual returns have been 28%.

As of Feb 2017, the Sensex is sitting on PE of 21.96 and according to model it predicts 1 percent returns over next two years, not a good sign indeed. It would interesting to visit the post in two years time, to validate the prediction.

The historical Sensex PE can be obtained from BSE website

http://www.bseindia.com/markets/keystatics/Keystat_index.aspx?expandable=2

But having said that if you are investing through SIP with long term view , it should not bother you.

For those who invest in individual stocks, its good idea to pick up quality stocks when PE is below 18.

http://www.morningstar.in/posts/36274/how-investors-can-use-the-pe-ratio.aspx

The results are interesting and give us fair idea where sensex might be headed in coming 2 years.

For example if Sensex PE is in range 16-17 the model predicts 26% return over two years and actual returns have been 28%.

As of Feb 2017, the Sensex is sitting on PE of 21.96 and according to model it predicts 1 percent returns over next two years, not a good sign indeed. It would interesting to visit the post in two years time, to validate the prediction.

The historical Sensex PE can be obtained from BSE website

http://www.bseindia.com/markets/keystatics/Keystat_index.aspx?expandable=2

But having said that if you are investing through SIP with long term view , it should not bother you.

For those who invest in individual stocks, its good idea to pick up quality stocks when PE is below 18.

Comments