Volatility in equity markets is your friend, proof lies in numbers

I hear a lot of friends, colleges, relatives and even my better half afraid of investing in equities. To some extent the fear is justified as they have witnessed the events that unfolded in 2008 market crash.

But what if told you that you could have profited from the crash and subsequent volatility.

There are some assumptions that you need to be aware of.

But what if told you that you could have profited from the crash and subsequent volatility.

There are some assumptions that you need to be aware of.

- You have surplus income which you don't need for long period of time.

- For most salaried people it is some portion of salary they can allocate for long term goals.

- You are willing to continue your sip with mutual funds with long track record and trust the Mutual Fund Manager

- You believe in Indian economy, and are willing to overlook the short term set backs.

- If events like Brexit, Demonetization and Trumphication, give you sleepless nights then either change your thought process of stay away from equities.

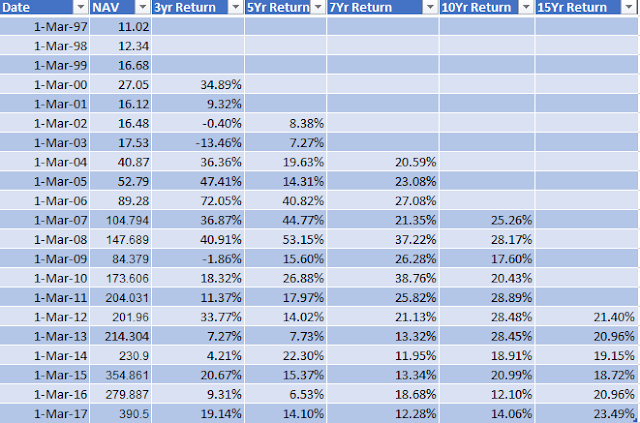

Lets take HDFC top 200 Fund as an example which has long history of more than 20 years and Managed by well known Fund Manager Mr. Prashant Jain

From the Graph below you can see that from Jan 2008 the fund had a downward fall till May 2009 when it started moving up and regained its earlier price on Jan 2010.

It is clear that over the period Jan 2008 and Jan 2010 the lump sum investment would have given negligible returns on the invested amount.

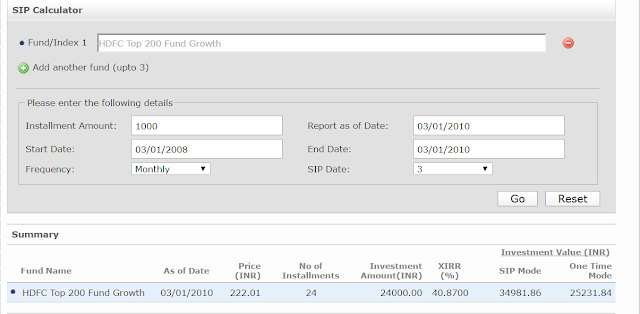

What if you had continued invested during this period via SIP. I will let the numbers speak for themselves.

While the one time investment of Rs 24,000 would have grown to Rs 25,231 only, on the other hand a SIP for same amount spread over two years of time would have grown to Rs 34,981 at XIRR of 40.8% .

The point I wanted to convey is that SIP returns are best when there is volatility markets. Even if markets are stagnant, this phase is an excellent opportunity to increase your corpus.

Comments