Are mid caps stocks overvalued?

Mid-cap stocks are having good run on exchange since the General Election of 2014.

The overall valuation can be judged by analyzing the P/E graph for NIFTY Free Float Midcap 100 since it was created,

The P/E value for NIFTY Free Float Midcap is hovering around 32 as of today, which is highest till date since the inception of this index. Even during market crashes of 2006 and 2008 the PE was well below current value at around 26.

The median value for PE for index is 16.83 and mean is 17.6. Reversion to mean is well known phenomenon our mid cap stocks are showing no signs of retreat as of now, only time will tell.

From behavioral aspect I can see more retail investors flocking to mid and small cap Mutual funds as the rate of interest on FD is declining.

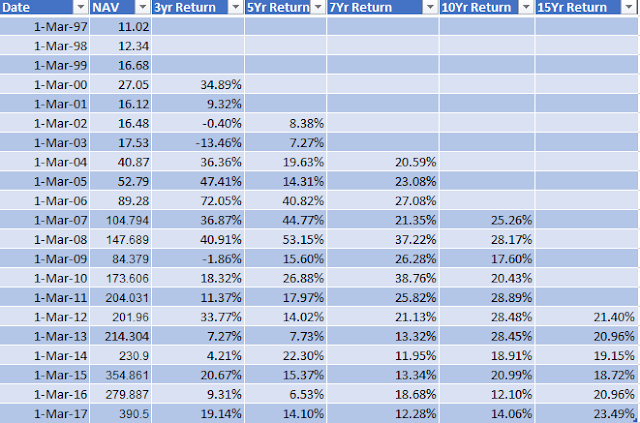

The index movement taken form edelweiss shows the following pattern. Note that the PE values and price values move in similar pattern from February 2014 own wards, which means price have been rising without any significant rise in earnings. The index have almost doubled from 2014 over three years of time giving a returns of CAGR 25%.

The overall valuation can be judged by analyzing the P/E graph for NIFTY Free Float Midcap 100 since it was created,

The P/E value for NIFTY Free Float Midcap is hovering around 32 as of today, which is highest till date since the inception of this index. Even during market crashes of 2006 and 2008 the PE was well below current value at around 26.

The median value for PE for index is 16.83 and mean is 17.6. Reversion to mean is well known phenomenon our mid cap stocks are showing no signs of retreat as of now, only time will tell.

From behavioral aspect I can see more retail investors flocking to mid and small cap Mutual funds as the rate of interest on FD is declining.

The index movement taken form edelweiss shows the following pattern. Note that the PE values and price values move in similar pattern from February 2014 own wards, which means price have been rising without any significant rise in earnings. The index have almost doubled from 2014 over three years of time giving a returns of CAGR 25%.

Comments